What’s the Best Bank For Small Business Checking and Savings?

Did Your Tax Preparer Forget To Sign Their Name or Include a PTIN?

Just when you thought your tax return was correctly signed, sealed and delivered, the IRS just informed the public that 100,000 tax preparers did not include a correct Preparer Tax Identification Number (PTIN). As part of the IRS’s initiative to increase its oversight over the tax preparation industry, tax preparers are now required to obtain a PTIN and include it with their signatures on the tax returns that they prepare. You might be asking yourself, “How do I know if my tax preparer included what they were suppose to when the tax return was prepared.” Read More.

Keeping Credit Card Spending in Check

Those that have difficulty managing credit card spending often justify their purchases with this thought, “I’ll pay it off later.” As a result, they make more purchases and spend more money on each item than they would if they used a debit card or paid with the cash in their wallet. Read More.

Parents with Teenage Drivers Can Reduce their Car Insurance Costs

By now, most if not all banks have implemented new banking fees to make up for the lost revenue as a result of the recently passed credit card relief bill. What was once “free” checking now comes with a fee and minimum monthly balance requirements are in vogue again. But, there are still ways to reduce or avoid the fees and you don’t necessarily have to change banks to do it. Read More.

How Your Credit Report (Not Score) Is Used By Potential Employers

Avoid Hurting Your Credit Score During a Trip

The dog days of summer are here which means plenty of us are booking trips to get out of town. Whether your travel plans are domestic or international, chances are you’ll be using your credit card for at least some of your travel expenses. While this is concerning for us finance folks with the average card holder in $14,753 of credit card debt, we know travel is inevitable. Learn what you need to do to avoid hurting your credit score. Read More.

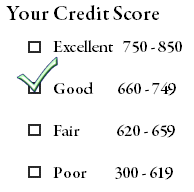

What You Need to Know When Checking Your Credit Score

It’s important to keep an eye on your credit report and credit score for many reasons. One of the key reasons is that they are used by lenders to determine if you are eligible for a loan, and if so, at what interest rate. The higher your credit score, the better chance you’ll have of getting a loan or credit card with favorable terms. Read More.

In a couple of months, Junior will be scrambling for new pens, paper, erasers and whatever else he can get his hands on. You can be the parent that waits until the last minute and pays the highest prices while also waiting on the longest lines or you can save time and money by planning ahead for back to school purchases. Read More.