Please join us for this webcast in which we will identify and assess effective small business year-end strategies for 2017 and beyond. We will cover techniques for managing overall income tax liabilities, timing of income and deductions, and the latest regulatory developments applicable to business taxation. Read More.

Webinar: Year End Tax Planning For The Small Business

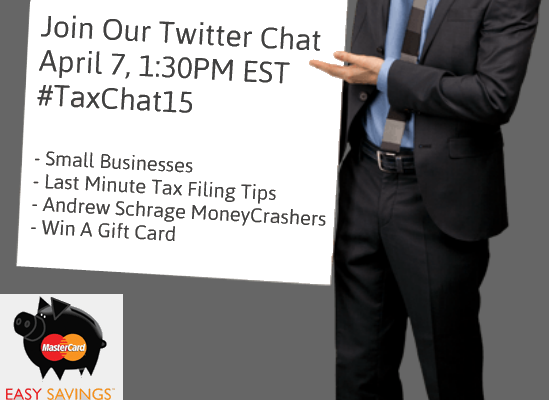

Recap Of Our Small Business Twitter TaxChat

We had the pleasure of hosting a small business Twitter TaxChat15 with Andrew Schrage from Money Crashers with the help of MasterCard. We asked 9 thought provoking tax questions to Andrew and the rest of the community. If you were unable to join the chat, we’ve compiled the key highlights from the discussion Read More.

Join Our TaxChat For Small Businesses on Tuesday 4/7, 1:30PM EST

BIDaWIZ and our partner, MasterCard, will be hosting a Twitter TaxChat on Tuesday 4/7 at 1:30PM EST to discuss last minute tax filing tips for small businesses with Andrew Schrage from Money Crashers. Andrew is a personal finance and small business expert that leads the Money Crashers team in developing a community of people who try to make financially sound decisions. Andrew as well as our team of tax professionals will be answering all of your tax questions in 140 characters or less. #TaxChat15 to participate. Read More.

What If Your Business Missed The 1099 Filing Deadline?

The initial 1099 filing deadline passed on February 2nd, 2015. This may have many businesses scrambling. What should businesses do if they are in this predicament and how can they avoid facing penalties. We address this concern and other 1099 tax questions. Read More.

Are Health Insurance Reimbursement Plans Now Allowed Per The IRS?

If you haven’t already heard, the IRS released an update on the tax rules for health insurance reimbursement plans as it relates to the Affordable Care Act (ACA) and S Corps. This update addresses small businesses that do not offer healthcare coverage, but do reimburse employees for insurance purchased on the healthcare exchanges. The IRS is now waiving noncompliance penalties for the 2014 tax year and the first half of 2015. Read More.

Sales & Use Tax Compliance For The Small Business Owner

Small businesses owners need to stay up to date on all of the regulatory changes that surround sales and use tax laws to avoid potentially devastating penalties to their business. Fortunately, Avalara provides a unique perspective of the sales tax complexities that businesses face as well as the best ways to mitigate the risks associated with sales tax compliance. Join us for this free sales tax webinar. Read More.

Does Gross Revenue Reconcile With Your 1099-K Form?

Is Your Company Eligible For S Corporation Late Election Relief?

Many new businesses and existing C Corporations elect to be treated as an S Corporation for the tax benefits. In some instances, companies fail to meet the filing deadline, which is 75 days after incorporating or 2 months and 15 days after the beginning of the tax year. If your business failed to meet this deadline, you may still qualify for S Corporation late election relief. Read More.

What Accountants And Businesses Need To Know About Form 3115

This tax season will have many businesses and accountants spending more time preparing returns as a result of the new form 3115 requirement. For those late to the party, the final regulations have been issued by the IRS for the tax treatment of tangible property. The purpose of the new requirement is to ensure that tangible property items were properly capitalized or expensed. Read More.

Does Letting Employees Telecommute Create Tax Nexus?