How Your Credit Report (Not Score) Is Used By Potential Employers

Avoid Hurting Your Credit Score During a Trip

The dog days of summer are here which means plenty of us are booking trips to get out of town. Whether your travel plans are domestic or international, chances are you’ll be using your credit card for at least some of your travel expenses. While this is concerning for us finance folks with the average card holder in $14,753 of credit card debt, we know travel is inevitable. Learn what you need to do to avoid hurting your credit score. Read More.

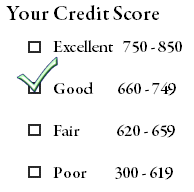

What You Need to Know When Checking Your Credit Score

It’s important to keep an eye on your credit report and credit score for many reasons. One of the key reasons is that they are used by lenders to determine if you are eligible for a loan, and if so, at what interest rate. The higher your credit score, the better chance you’ll have of getting a loan or credit card with favorable terms. Read More.

Getting Your Child Financially Ready For College

What’s The Best Way To Pay For Purchases When Overseas?

With Gas Prices So High, Is There a Good Way I Can Still Save?

There are certainly ways to save money at the pump when you use particular credit cards. In the past year alone, gasoline has gone up by about $1 a gallon, and putting a pinch on many consumers’ budgets. If that’s not enough, the price hikes are predicted to continue, and some experts say prices could jump as high as $6 a gallon. Read More.

My Parents’ Credit Card Account is Hurting My Credit Score

Believe it or not, the following scenario is all too common: “I just saw my credit report for the first time & there was a credit card account that I had no knowledge of. When I called the bank that held the account, they told me it was somehow attached to my mom. The account was opened in 1996, I would have been ten years old at the time, and my name is attached to the account! Not only was this account opened without my knowledge, it has hurt my credit score as there are multiple late payments.” Read More.

Should I Use a Debt Settlement Company Now?

Should My Child Be an Authorized User on My Credit Card Account?

Many parents don’t realize the benefits that come along with adding their child to their credit card account as an authorized user. Instead, they are focusing more on the risk that their child may not be financial responsible enough to have that privilege. But, if you are not worried about your child running up your credit card bill, sign them up as an authorized user which will better prepare them for the future. Read More.

Should I Close My Credit Card Account?

Let’s get one thing straight. Closing a credit card account DOES hurt your credit score (i.e. FICO Score). Now, the degree that your credit score may be impacted depends on several factors which we will discuss below. Read More.