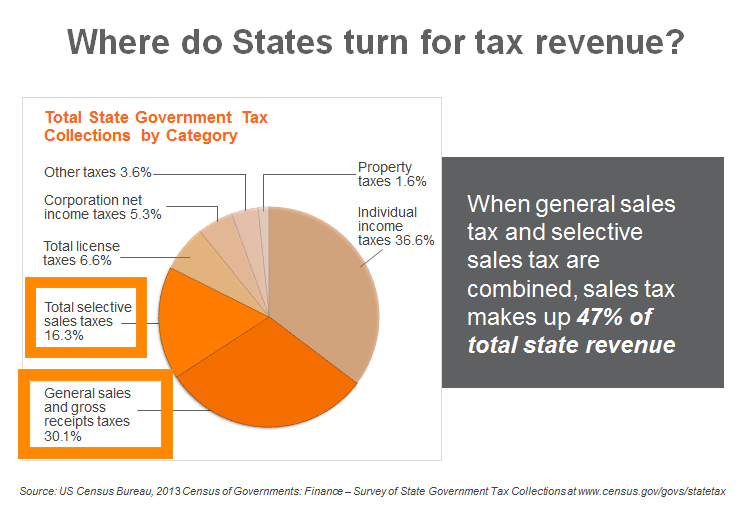

Nearly half of state revenue is generated from sales tax sources. Specifically, general sales tax accounts for 30.1% of total state tax revenue and selective sales tax (liquor, fuel, tobacco) totaled 16.3% in 2013. As such, state regulators try to collect every dollar that is owed to them. This may mean that your business could be at risk should you not have the appropriate reporting processes in place to ensure sales tax compliance with the authorities. Fortunately, we recently had the opportunity to speak with Brandon Houk to learn more about how Avalara can help businesses with sales tax compliance.

How can Avalara help small businesses with sales tax compliance?

Automated sales tax solutions like Avalara substantially mitigate the risk of non-compliance and allow small businesses to allocate more of their time toward revenue generating activities.

What are the common sales tax mistakes businesses are making?

In our 10 year history, we’ve noted that the type of sales tax mistakes our clients are making has changed over time. Currently, I’ve noted common mistakes in misinterpreting nexus, poor document control for exemption certificates and simply under-collecting tax due on certain products. These mistakes all could be avoided by taking proactive measures to seek answers and implement the appropriate sales tax solution.

It’s also important to keep in mind that budget shortfalls have made some states more aggressive in audits and it’s just not worth the risk – find resources, talk to your CPA, get educated and be proactive.

Does sales tax compliance risk vary by business and region?

Sales tax is inherently complex and variable because authority to levy sales taxes resides at the state and local level. This is why we have 10,000+ taxable jurisdictions in the United States. In addition, there are even crazy product tax rules and tax holidays that differ from street to street in some places.

What should businesses consider when reviewing a sales tax compliance solution?

The good news is there have never been more options a business has for simplifying their sales tax compliance through technology. The right solution is the one that delivers the most value through process efficiency and risk mitigation compared to the cost of the solution.

Why should businesses choose Avalara over the competition?

Our technology really sets us apart. We have pre-built integrations to over 300 accounting, ecommerce, ERP, & POS solutions so there is very little implementation time. Our approach to tax content and how it is delivered is also unique. We manage every rate and rule that most businesses need and we can file returns anywhere in North America and Europe. What’s more, our prices are even affordable for single state filers because we charge on a transaction basis.

Can you provide an example of a business that benefited from using Avalara?

A client that comes to mind is the jewelry company, David Yurman Corporation. Believe it or not, they were managing sales tax compliance manually. This became a big problem as they weren’t equipped to keep up to date with the changing sales tax rates and regulations in the various states and jurisdictions that they were shipping to. It was simply too much to manage on their own and they needed a system that could tackle state-by-state issues quickly, easily and accurately. They began using our Avalara AvaTax solution and haven’t looked back. They’re no longer spending hours researching and updating sales tax information manually and can now have peace of mind that they are compliant with sales tax regulations.

How should a business contact you if their interested in learning more about Avalara?

They can reach out to me directly for answers or a live demonstration. My contact information is detailed below or they can simply learn more here.

Brandon Houk

Brandon.houk@avalara.com

206-276-9887

More Questions? Ask your sales tax questions or find a cpa online.

Related Articles

->The Top Three Most Tax-Friendly States For Businesses

->2013 Sales Tax Holidays To Benefit Back-To-School Shoppers

->Amazon Will Begin Collecting California State Sales Tax

->What Types Of Travel And Entertainment Expenses Can You Writeoff?

->Online Shoppers May Have To Pay A Use Tax Soon

->What Is The Correct Amount Of Sales Tax For Discounts & Groupons?

Tags: sales tax, accountants, sales tax questions, Ryan Himmel