Trusted Answers From Licensed Business Professionals

What Types of Travel and Entertainment Expenses Can You Writeoff?

By The BIDaWIZ Team on March 16th, 2012 at 2:00 pm

Tax Deductible Commuting Costs That Can Benefit The Self Employed

By The BIDaWIZ Team on March 1st, 2012 at 4:00 pm

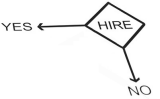

When Is the Right Time To Start Hiring Again?

By The BIDaWIZ Team on February 27th, 2012 at 5:00 pm

Key Business Tax Breaks Have Not Been Reinstated Yet

By The BIDaWIZ Team on February 17th, 2012 at 11:00 am

What Small Business Tax Breaks Changed with the New Year?

By Susan Ladika on January 5th, 2012 at 1:30 pm

The Self Employed Can Get a Big Tax Break From Retirement Savings

By The BIDaWIZ Team on November 29th, 2011 at 6:00 pm

As we head into the final month of 2011, now is the time to start acting on year end tax saving strategies. For those that are self employed or have a side business, the savings can be significant by contributing to a tax friendly retirement plan now or or before April 16, 2012. Read More.

Do I Qualify for the Small Business Health Care Tax Credit?

By Susan Ladika on November 3rd, 2011 at 6:45 pm

The 2011 Small Business Tax Breaks Set to Expire, Unless…

By The BIDaWIZ Team on September 29th, 2011 at 3:00 pm

Are Sales Tax Holidays Good For Business?

By The BIDaWIZ Team on July 29th, 2011 at 1:00 pm

Small Business Tax Breaks & More On The Way

By The BIDaWIZ Team on January 28th, 2011 at 11:06 am

The tax reform proposed by President Obama during the State of the Union Address hinted towards additional business tax credits and the possibility of a lower corporate tax rate in the upcoming years. This reform would be in addition to the 2010 tax credits and deductions already available to businesses. Read More.