Please join us for this webcast in which we will identify and assess effective small business year-end strategies for 2017 and beyond. We will cover techniques for managing overall income tax liabilities, timing of income and deductions, and the latest regulatory developments applicable to business taxation. Read More.

Webinar: Year End Tax Planning For The Small Business

Do I Have To Repay The First Time Homebuyer Credit Immediately?

The first-time homebuyer credit for homes purchased in 2008, with few exceptions, must be repaid over a 15 year period and takes the form of a $7,500 interest-free loan. What happens if the home is sold or no longer is your primary residence? In this instance, the repayment may be due in the year that chance occurs. Read More.

Tax Nexus For Employers That Allow Employees To Telecommute

Employers that allow their employees to telecommute across state lines may be at risk for exposing their company to additional tax filings. Each state has a different set of rules for establishing nexus or “doing business” in their state, but there are a few general principles to follow. Read More.

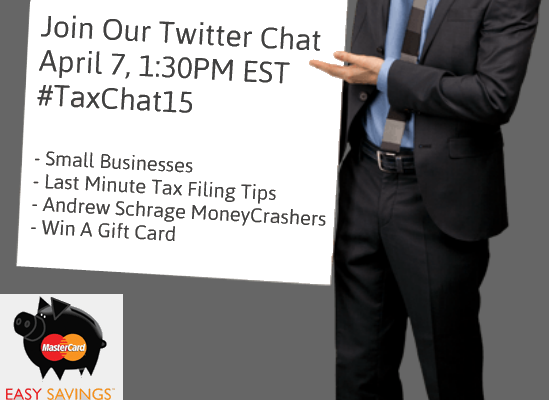

Recap Of Our Small Business Twitter TaxChat

We had the pleasure of hosting a small business Twitter TaxChat15 with Andrew Schrage from Money Crashers with the help of MasterCard. We asked 9 thought provoking tax questions to Andrew and the rest of the community. If you were unable to join the chat, we’ve compiled the key highlights from the discussion Read More.

Join Our TaxChat For Small Businesses on Tuesday 4/7, 1:30PM EST

BIDaWIZ and our partner, MasterCard, will be hosting a Twitter TaxChat on Tuesday 4/7 at 1:30PM EST to discuss last minute tax filing tips for small businesses with Andrew Schrage from Money Crashers. Andrew is a personal finance and small business expert that leads the Money Crashers team in developing a community of people who try to make financially sound decisions. Andrew as well as our team of tax professionals will be answering all of your tax questions in 140 characters or less. #TaxChat15 to participate. Read More.

Are Travel Expenses Deductible When On A Long-Term Project?

The short answer is that it depends. Generally, the rules for deducting travel and living expenses while away from home depend on how long the work is being performed away from your family home. Read More.

Do You have Any Unclaimed Tax Refunds?

If you haven’t filed your 2011 tax return and claimed your refund yet, you may be one of the 1.2 million taxpayers that are owed $1 billion in refunds. The IRS estimates more than half of the refunds are for at least $698. Read More.

What If Your Business Missed The 1099 Filing Deadline?

The initial 1099 filing deadline passed on February 2nd, 2015. This may have many businesses scrambling. What should businesses do if they are in this predicament and how can they avoid facing penalties. We address this concern and other 1099 tax questions. Read More.

Are Health Insurance Reimbursement Plans Now Allowed Per The IRS?

If you haven’t already heard, the IRS released an update on the tax rules for health insurance reimbursement plans as it relates to the Affordable Care Act (ACA) and S Corps. This update addresses small businesses that do not offer healthcare coverage, but do reimburse employees for insurance purchased on the healthcare exchanges. The IRS is now waiving noncompliance penalties for the 2014 tax year and the first half of 2015. Read More.