Why A Roth IRA Makes Sense For a Teenager

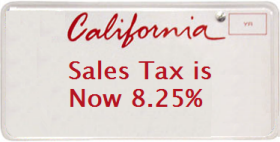

Is California State Sales Tax Ever Coming Down?

Despite desperate calls from small business advocacy groups to implement fiscal policies that spur economic growth, California maintains the highest state sales tax rate in the country. A whopping 8.25%. To refresh your memory, California recently (4/1/09) increased the state sales tax by 1% to compensate for the massive budget crisis. The good news is that the 1% “temporary” increase is set to expire on June 30, 2011. But, with all of these sales tax changes, how should small businesses prepare their books? Read More.

Where Is My California State Tax Refund?

Californians seem to get no breaks. State income tax refunds still have not been issued to both individuals & businesses due to the State’s “Cash Flow Problems.” That can anger many taxpayers because essentially they have given their government a loan & haven’t gotten paid back on time. So how long do these taxpayers have to wait for tax refunds? Read More.

Why Is My Tax Refund Lower Than I Expected?

Managing Your Out of Pocket Expenses

My Parents’ Credit Card Account is Hurting My Credit Score

Believe it or not, the following scenario is all too common: “I just saw my credit report for the first time & there was a credit card account that I had no knowledge of. When I called the bank that held the account, they told me it was somehow attached to my mom. The account was opened in 1996, I would have been ten years old at the time, and my name is attached to the account! Not only was this account opened without my knowledge, it has hurt my credit score as there are multiple late payments.” Read More.

How Do 529 Plans Compare to Other College Saving Options?

Does It Make Sense To Go To Vocational School?

Planning For Capital Gains Tax in 2011

The decision to sell this investment now or wait until next year is becoming more and more important. Tax rates across the board will likely start to increase in 2011 with long-term capital gains tax increasing at least 5% from 15% to 20% or even higher. Therefore, it is strongly advised to review your portfolio and the impact that a transaction will have on your tax liability, if any. Read More.