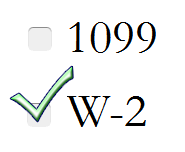

Individual year-end tax strategies should account for the breaks that are set to expire come January 2012. Mainly, accelerate the deductions associated with these breaks to get the full benefit of them before it’s gone in 2012. Find out which tax breaks are set to expire and how to prepare. Read More.