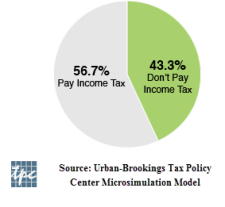

For some tax filers, their tax bill this year will be greater than in the past. Specifically, certain taxpayers in the 35% tax bracket last year may see that figure increase to 39.6%. In addition, if you have sold a business or had large capital gains this year, your tax bill will likely be higher for your 2013 tax return. How will you be impacted and what can you do to still save on taxes? Read More.